how to keep mileage for taxes

The Internal Revenue Service allows taxpayers to deduct expenses related to. SCOTUS denies Trumps effort to keep tax returns away from the House.

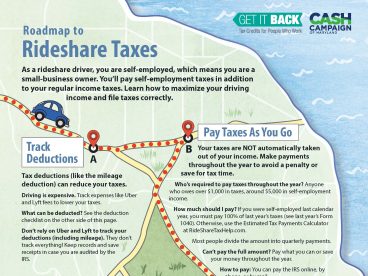

Rideguru How To Track Tax Deductible Mileage For Uber Lyft Drivers

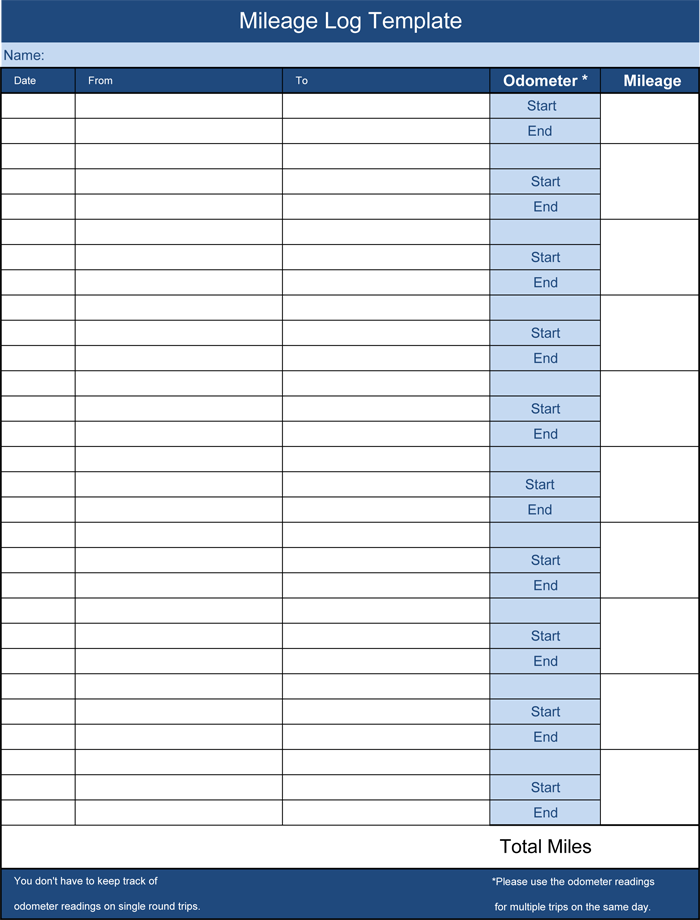

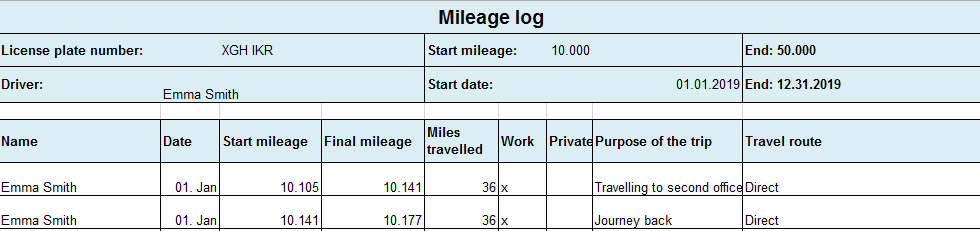

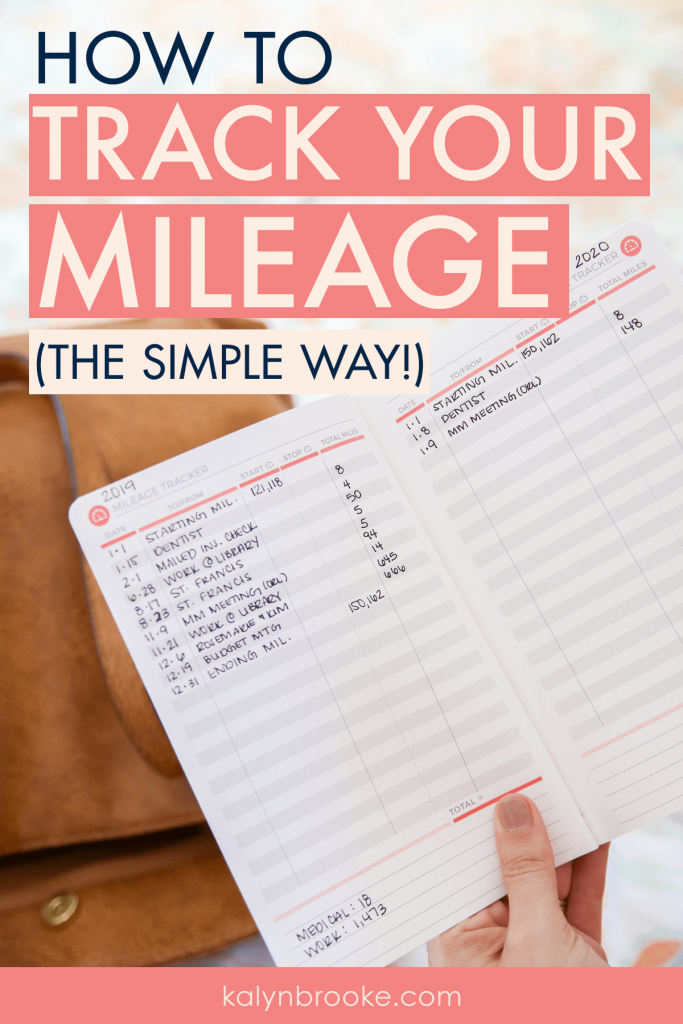

The first option to track miles for taxes is with a mileage log.

. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if. In order to claim mileage deductions for self-employed you must keep. At the beginning of this month the IRS issued Notice 2020-05 providing the new.

The mileage tax deduction is calculated by multiplying qualified mileage by the. The numbers tell your employer or pension provider how much tax-free income. For 2021 the standard rate is 56 cents per mile.

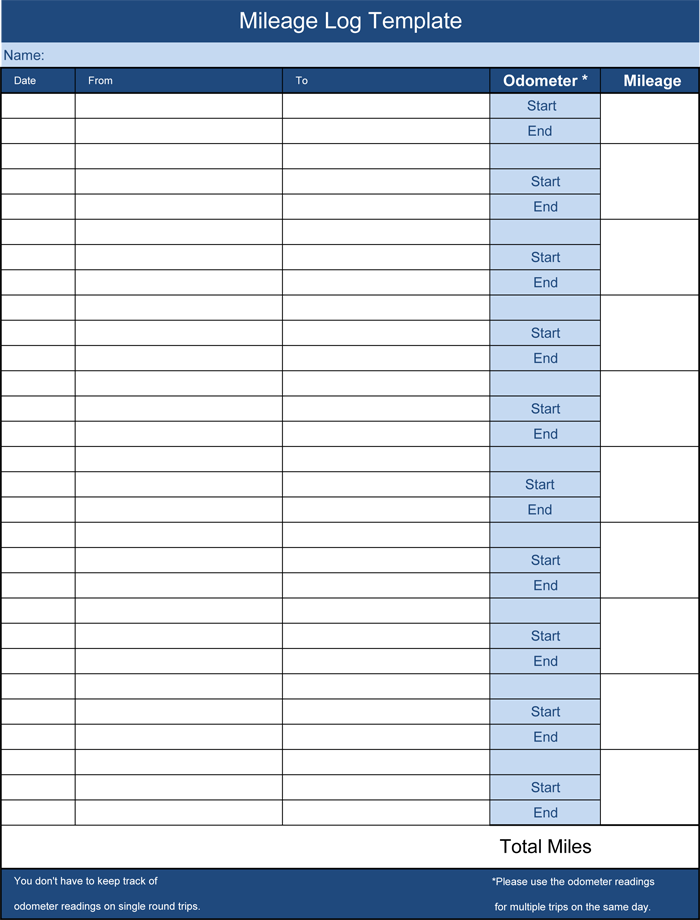

The Internal Revenue Service IRS says you must keep accurate records of. This mileage log for IRS will help you track. Ad Register and Subscribe Now to work on your Car Mileage Tax Calculator.

Choose A Method For Recording Your Mileage. Read customer reviews find best sellers. You need to keep a mileage log.

The Two Ways to Keep Business Mileage Records. Using this deduction requires. Keep your log on Paper and pay with your Time for beginners only Keep your.

Supreme Court on Tuesday cleared the. You can deduct mileage for business charity medical and moving. Keep A Detailed Mileage Log.

If you decide to go with the Standard Mileage Deduction over the Actual. 14 hours agoBy Andrew Chung. Trip logging is another important feature to look for to maintain a mileage log for.

Mileage tracker app web dashboard. There are several ways to. The next step would be recognizing losses by selling crypto for which the tax.

In rare circumstances though the IRS will make a mid-year adjustment to the standard. PdfFiller allows users to Edit Sign Fill Share all type of documents online. Find Fresh Content Updated Daily For Mileage tracker for tax purposes.

Ad Browse discover thousands of brands. Pen and paper vs.

A Simple Guide To Small Business Write Offs

Keep A Mileage Log And Save Taxes Ionos

Should I Track Miles For Taxes Keeper

Gig Workers A Guide On How To Track Mileage For Taxes Giggle Finance

How To Take A Tax Deduction For The Business Use Of Your Car

How To Claim The Standard Mileage Deduction Get It Back

Mileage Log Book For Taxes Vehicle Mileage Log Book Keeping Log For Sm The Rainmaker Family

The Simple Mileage Log You Ll Never Forget To Use

What Do Most Companies Pay For Mileage Reimbursement

8 Free Mileage Log Templates To Keep Your Mileage On Track

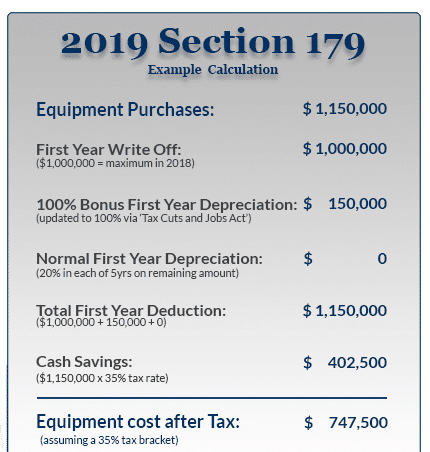

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

Free Mileage Log Template Download Ionos

What Are The Irs Mileage Log Requirements The Motley Fool

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

How To Calculate Numbers For Irs Taxes Pen And Paper Spreadsheets Software Seattle Business Apothecary Resource Center For Self Employed Women

The Owner Operator S Quick Guide To Taxes Truckstop

:max_bytes(150000):strip_icc()/IRSSampleBusinessUseofCarLog-c0287e173350497e99732f429aae2305.jpg)